ADX Explained: Boost Your Trading Profits with This Tool

???? What Is ADX? The Powerful Indicator Every Trader Must Know

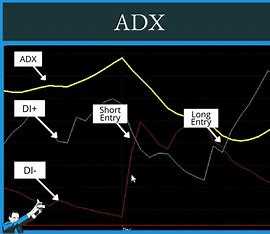

ADX (Average Directional Index) is one of the most trusted technical indicators used in stock, forex, and crypto trading. Created by Welles Wilder, it helps traders identify the strength of a trend, regardless of its direction.

Whether you’re a beginner or an experienced trader, mastering ADX can give you an edge in volatile markets.

✅ How ADX Works

- ADX Value Below 20: Weak or no trend

- ADX Value Above 25: Strong trend

- ADX > 40: Very strong momentum (ideal for trend-following strategies)

???? Note: ADX doesn’t tell you the direction of the trend—only how strong it is. That’s why it’s often paired with +DI and -DI lines to determine bullish or bearish trends.

???? Real-Life Trading Example Using ADX

Let’s say you’re trading Bitcoin (BTC). The ADX line rises above 25 while the +DI crosses over the -DI line. This means a strong bullish trend is likely forming. Smart traders enter long positions here—often before the big rally happens.

???? Why Traders Love ADX

- Works in any market: Stocks, crypto, forex

- Avoids false signals by filtering weak trends

- Easy to combine with RSI, MACD, or moving averages

- Helps you stay in profitable trades longer

???? Best ADX Trading Strategy (Simple)

- Wait for ADX > 25

- Confirm trend with +DI and -DI

- Use a stop-loss below the last swing low/high

- Exit when ADX starts to decline or crosses back below 25

???? The Future of Trading with ADX

With algorithmic and AI-based trading on the rise, professional traders now use ADX in automated bots and machine learning strategies. Platforms like TradingView, MetaTrader, and Binance offer built-in ADX tools for fast decision-making.

???? Conclusion

ADX isn’t just another indicator—it’s a must-have weapon for smart traders who want to ride big trends and avoid noisy markets. If you’re serious about profits, start testing ADX today.